Are you hearing different things out there about prices and real estate values. Consider the source first!

Engage with Real Estate Professionals:

In addition to consulting with mortgage professionals, engaging with real estate agents and other industry experts can provide valuable insights into the local market dynamics. Seek guidance from professionals who have a deep understanding of your desired location and can provide personalized advice based on your unique requirements.

Economic Indicators:

Economic indicators play a significant role in predicting future home prices. Factors such as employment rates, wage growth, and overall economic stability can have a direct impact on the housing market. A robust economy often leads to increased demand for housing, which can result in higher home prices. Keeping an eye on economic trends and indicators can provide valuable insights into the direction of the real estate market.

Supply and Demand:

The fundamental principle of supply and demand is pivotal in understanding home price trends. A shortage of housing inventory coupled with high demand can drive up home prices, while an oversupply of homes can lead to a decrease in prices. Monitoring housing inventory levels and buyer demand in your desired location can give you an indication of the future trajectory of home prices.

Interest Rates:

Interest rates have a profound influence on the affordability of homes. Lower interest rates can make homes more accessible to buyers, potentially driving up demand and prices. Conversely, higher interest rates can dampen demand and put downward pressure on home prices. Keeping track of interest rate trends can provide valuable insights into the future affordability of homes.

Local Market Dynamics:

Real estate is inherently local, and understanding the dynamics of your specific market is crucial. Factors such as population growth, neighborhood developments, and local zoning regulations can all impact future home prices. Researching your target area and gaining a deep understanding of the local market dynamics can give you a competitive edge in predicting home price trends.

While understanding the factors that influence home prices is essential, it's equally important to take proactive steps to reach your desired home buying goals. Here are some suggestions to help you navigate the process:

Consult with a Knowledgeable Mortgage Loan Officer:

Navigating the complexities of the real estate market can be daunting, which is why it's crucial to seek guidance from an experienced mortgage loan officer. Our team of competent loan officers has in-depth knowledge of the factors that influence home prices and can provide valuable insights tailored to your specific needs. Reach out to us to go over your specific requirements and gain a deeper understanding of the home buying process.

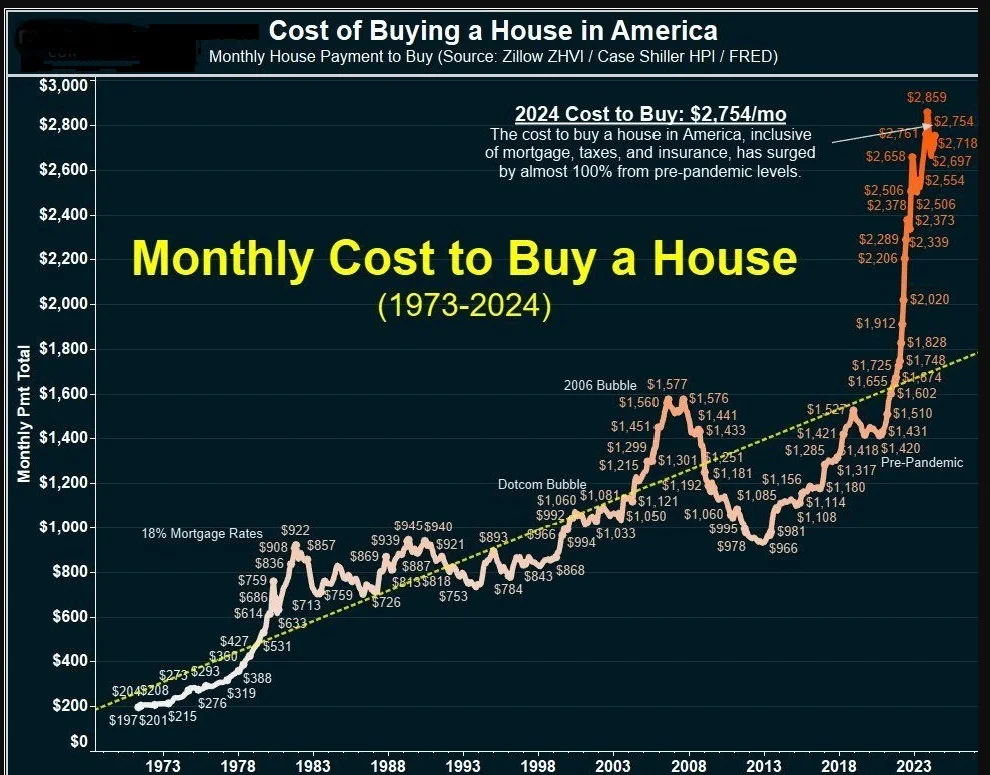

Opinion: This chart is incredibly useful. I firmly believe that the term "value" has been overused and should no longer be relied upon. Instead, "cost" should be the primary consideration for any decision-making process. When considering inflationary pressures of material cost and labor cost, it becomes clear that cost should be the deciding factor. As a seasoned construction lender, I have witnessed costs skyrocket since 2008. I can hardly remember what it used to cost per vertical square foot.

The build-up to the GCF led people to purchase homes they couldn't afford from a personal cash flow standpoint. This created a bubble for demand and assumed value appreciation. However, with the implementation of Dodd-Frank and the ATR rule (Ability to Repay), I confidently predict that values will not come crashing down. Anyone with cash can buy something for less than it “Costs” to build, which is where Wall Street/Hedge Funds enter the picture, locking out the average person who dreams of purchasing a fixer-upper.

Brent Adams